Churn doesn’t start with a cancellation email.

It starts much earlier, when customers quietly begin looking elsewhere.

They’re still active. They haven’t complained. But behind the scenes, they’re researching competitors, comparing pricing, and exploring alternatives.

These are wandering eyes, and if you can spot them early, you can intervene 60 days before churn becomes inevitable.

Why Most Churn Signals Arrive Too Late

Most retention efforts rely on lagging indicators:

-

Declining usage

-

Support tickets

-

NPS drops

-

Renewal objections

By the time these appear, the decision is often already made.

The real early warning signs live outside your product, in what customers research when they think no one is watching.

The Hidden Churn Signal: External Intent

Customers don’t stop researching just because they signed a contract.

When confidence drops, curiosity rises:

-

Competitor pricing searches

-

“X vs Y” comparisons

-

Review site activity

-

Category alternatives

This is where churn actually begins, long before usage falls off.

To act on this, you need a proactive system.

That’s where the Revenue Shield workflow comes in.

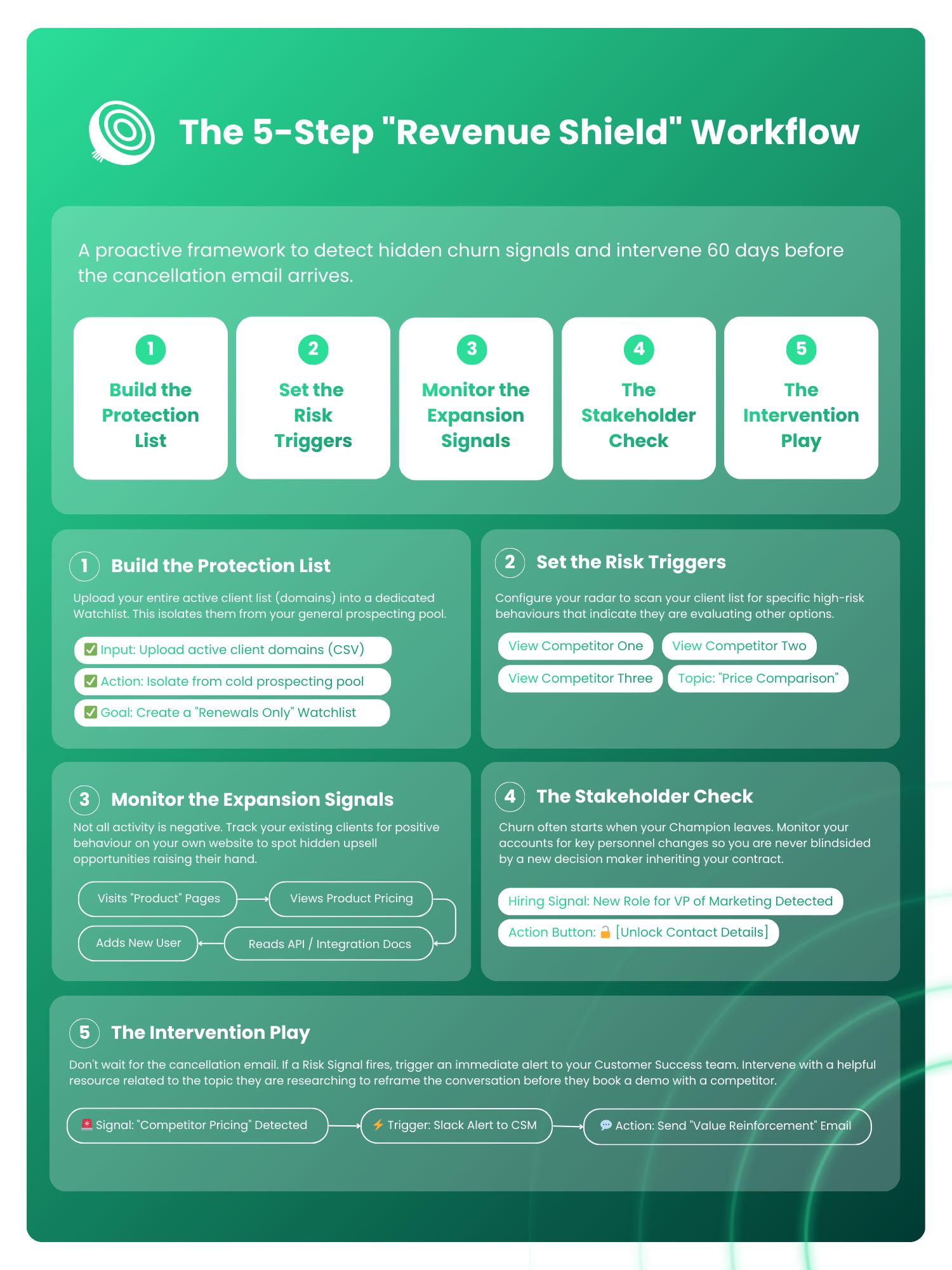

The 5-Step “Revenue Shield” Workflow

A simple framework to detect churn risk early and intervene before renewal conversations turn defensive.

1. Build the Protection List

Start by isolating your existing customers.

Upload active client domains into a dedicated watchlist so they’re monitored differently from cold prospects. This becomes your renewals-only view — focused purely on retention and expansion.

2. Set the Risk Triggers

Next, define what “wandering eyes” actually look like.

Examples:

-

Competitor brand searches

-

Pricing comparison topics

-

Engagement with alternative solutions

These triggers act as your early-warning radar, flagging accounts that are quietly evaluating options.

3. Monitor Expansion Signals (Not All Activity Is Bad)

Not every signal means churn.

Some behaviours indicate growth intent, such as:

-

Visiting product or pricing pages

-

Adding new users

-

Reading integration or API documentation

Tracking both risk and expansion signals gives you context, not panic.

4. The Stakeholder Check

Churn often starts when your internal champion leaves.

Monitoring hiring signals or role changes helps you spot when:

-

A new decision-maker enters the account

-

Influence shifts internally

-

Your value needs to be re-established

This prevents surprise non-renewals driven by silent org changes.

5. The Intervention Play

This is where most teams wait too long.

When a risk signal fires:

-

Alert Customer Success immediately

-

Reference what the customer is researching

-

Reinforce value with relevant content

-

Offer help before competitors get a meeting

This isn’t a discount play.

It’s a relevance play, timed when it still matters.

From Reactive Retention to Predictive Defence

Churn isn’t a usage problem. It’s an intent problem.

Teams that combine internal signals with external buyer intent don’t just react faster, they see risk sooner.

They intercept decisions while they’re still forming.

They protect revenue before it’s at risk.

They turn churn prevention into a competitive advantage.

Because by the time a cancellation email arrives, the real decision was made weeks ago.

The advantage is seeing it first, and acting early.